let’s partner up

Big Rock Brewery Inc. Announces 2018 Third Quarter Financial Results

For Immediate Release

CALGARY, ALBERTA, Big Rock Brewery Inc. (TSX: BR) (“Big Rock” or “the Corporation”) today announced its financial results for the three and nine months ended September 30, 2018.

“We are very pleased with the significant improvements we are making to our business, and the third quarter exemplifies that,” said President & CEO, Wayne Arsenault. “Increased year-over-year margins and pursuit of new business allowed us to achieve EBITDA for the quarter of approximately $1.5 million and net income of $587 thousand, improvements of $965 thousand and $766 thousand, respectively.”

“Subsequent to the quarter end we announced the closing of the amended transaction with Fireweed Brewing Corp. and have begun the installation in our Vancouver brewery of the assets purchased as part of the transaction,” commented Mr. Arsenault. “We anticipate that the increased capacity and productivity of our Vancouver brewery will contribute to our growth in profitability in 2019.”

Financial Highlights

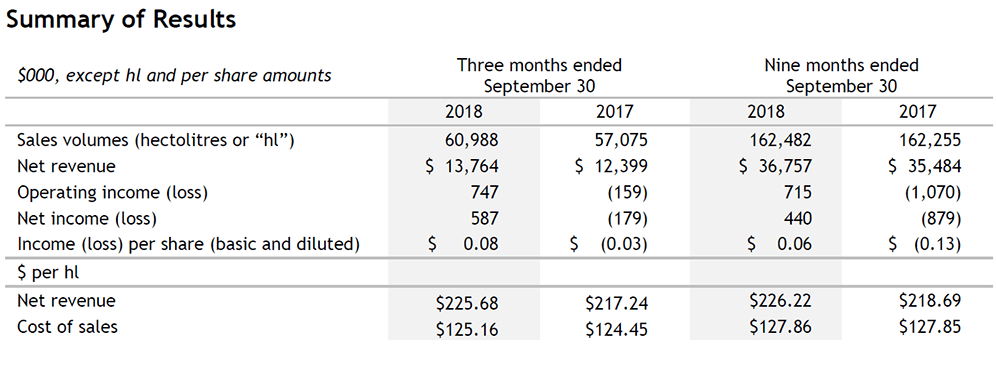

For the quarter ended September 30, 2018, compared to the third quarter of 2017, Big Rock:

- increased its net income by $766 thousand to $587 thousand, from a net loss of $179 thousand;

- improved its operating profit by $906 thousand to $747 thousand from an operating loss of $159 thousand;

- reported earnings before interest, tax, depreciation and amortization (“EBITDA”) of $1,544 thousand compared to $579 thousand;

- reported net revenue of $13,764 thousand, compared to $12,399 thousand, on sales volumes of 60,988 hl, compared to 57,075 hl; and

- achieved funds flow from operations of $1,587 thousand, compared to $556 thousand.

For the nine months ended September 30, 2018 compared to the first nine months of 2017, Big Rock:

- improved its net income by $1,319 thousand to a net income of $440 thousand, from a net loss of $879 thousand;

- reported operating profit of $715 thousand compared to an operating loss of $1,070 thousand;

- reported EBITDA of $3,056 thousand compared to $1,284 thousand;

- reported net revenue of $36,757 thousand, compared to $35,484 thousand, on sales volumes of 162,482 hl compared to 162,255 hl; and

- achieved funds flow from operations of $2,778 thousand, compared to $1,625 thousand.

Operating Highlights

The Canadian beer industry continues to be highly competitive, with numerous new craft breweries entering the marketplace. Despite competitive pressures, Big Rock’s reported results for the three and nine months ended September 30, 2018 improved over the comparative periods in 2017. The Corporation increased its sales volumes in third quarter of 2018 (versus the third quarter of 2017), primarily due to a transition and rationalization of value streams undertaken throughout 2018. Despite the discontinuation of select brands in 2018, contract brewing has more than fulfilled those discontinued sales volumes with the Corporation’s third quarter sales volumes up approximately 7% versus the third quarter of 2017 and roughly flat year-to-date. Additionally, gross profit margin improved in the third quarter and the nine months ended September 30, 2018 to 45% and 43% compared to 43% and 42% reported in the third quarter and nine months ended September 30, 2017. These improvements reflect the impact of pricing adjustments that were introduced in Alberta in late 2017 and in other regions during the first quarter of 2018 as well as improved Alberta net mark-up rates on beer and cider and increased operational cost efficiencies.

The Corporation continues to search for initiatives that will improve its asset utilization at its British Columbia (“BC”) and Ontario breweries. In April 2018, Big Rock announced it had entered into an agreement to form a contractual joint venture with Fireweed Brewing Corp. (“Fireweed”), to operate and manage the Vancouver brewery. However, certain closing conditions of the arrangement could not be satisfied. As a result, Big Rock announced on July 23, 2018 and subsequently closed on October 18, 2018 an amended transaction with Fireweed, to acquire certain brewing assets and inventory related to branded beer and cider for a gross purchase price approximately $670,000, less amounts owed by Fireweed to Big Rock. Subsequently, at closing, the parties entered into a license agreement by which Fireweed granted Big Rock exclusive rights to Fireweed’s trademarks and other intellectual property with an option to purchase the intellectual property outright. Additionally, at closing, the parties entered into contract manufacturing agreements which permits Big Rock to exclusively manufacture all of Fireweed’s branded products in BC and Alberta for a predetermined, volume-based fee. The amended transaction allows Big Rock to increase its production capacity and utilization at the Vancouver brewery.

In June 2018, an Alberta Trade Review panel ordered that the ASBD grant program be repealed or revised within six months, as it was found to place beer producers from other provinces at a competitive disadvantage in the Alberta market. Big Rock continues to work with the Alberta Government with the objective of drafting policy changes that will effectively stimulate the craft beer industry in the province. The impact of this impending regulatory change cannot currently be estimated, however, Big Rock anticipates the final result to be announced in November 2018.

Additional Information

The unaudited consolidated financial statements and Management’s Discussion and Analysis for the three and nine months ended September 30, 2018, dated November 1, 2018 can be viewed on Big Rock’s website at www.bigrockbeer.com and on SEDAR at www.sedar.com under Big Rock Brewery Inc.

Forward-Looking Information

Certain statements contained in this news release constitute forward-looking statements. These statements relate to future events or Big Rock’s future performance. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking information are not facts, but only predictions and generally can be identified by the use of statements that include words or phrases such as, “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “likely” “may”, “project”, “predict”, “propose”, “potential”, “might”, “plan”, “seek”, “should”, “targeting”, “will”, and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Big Rock believes that the expectations reflected in those forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon by investors as actual results may vary materially from such forward-looking statements. These statements speak only as of the date of this news release and are expressly qualified, in their entirety, by this cautionary statement.

In particular, this news release contains forward-looking statements pertaining to the following:

- expected sales volumes;

- the expected increase in average margins;

- projections of market prices and costs;

- treatment under governmental regulatory and taxation regimes, including expected price increases resulting from the indexing of excise taxes to inflation;

- supply and demand of Big Rock’s products;

- the impact of recent changes in Alberta mark-up rates and any further changes in the future;

- the expected repeal of the ASBD grant program, Big Rock’s efforts to work with the Alberta Government to implement policy changes to stimulate the craft beer industry in the province and the expected timing of resulting regulatory changes;

- the expected increased capacity and productivity of the Corporation’s Vancouver brewery and contribution to the Corporation’s profitability in 2019 from the Corporation’s acquisition of brewing assets and inventory from a BC brewer; and

- the expectation the Corporation will have adequate sources of funding to finance the Corporation’s operations.

With respect to the forward-looking statements listed above and contained in this news release, management has made assumptions regarding, among other things:

- volumes in the current fiscal year will remain constant or will increase;

- input costs for brewing and packaging materials will remain constant or will not significantly increase or decrease;

- there will be no supply issues with Big Rock’s vendors;

- the Corporation’s ongoing discussions with the Alberta Government will be successful in implementing policy changes favourable to Big Rock; and

- the Corporation’s acquisition of brewing assets and inventory from a BC brewer will improve the utilization of the Corporation’s Vancouver brewery.

Some of the risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking information and statements contained herein include, but are not limited to:

- the inability to continue to reduce the net mark-up rate in Alberta; and

- the inability to continue to grow demand for Big Rock’s products.

Readers are cautioned that the foregoing list of assumptions and risk factors is not exhaustive. The forward-looking information and statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking information and statements included in this news release are made as of the date hereof and Big Rock does not undertake any obligation to publicly update such forward-looking information and statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws.

Non-GAAP Measures

The term “earnings before interest, taxes, depreciation and amortization” (EBITDA) is not a recognized measure under GAAP and may not be comparable to that reported by other companies. EBITDA is calculated by adding back to net income, interest, income taxes and depreciation and amortization. Management uses this measure to evaluate the Corporation’s operating results. A reconciliation of EBITDA to net income (loss), the nearest GAAP measure, is contained under the section “Liquidity and Capital Resources – Capital Strategy” in the Corporation’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2018, dated November 1, 2018, which can be viewed on Big Rock’s website at www.bigrockbeer.com and on SEDAR at www.sedar.com under Big Rock Brewery Inc.

About Big Rock Brewery Inc.

In 1985, Ed McNally founded Big Rock to contest the time’s beer trends. Three bold, European-inspired offerings – Bitter, Porter and Traditional Ale – forged an industry at a time heavy on easy drinking lagers and light on flavour. Today, our extensive portfolio of signature beers, ongoing seasonal offerings, four ciders (Rock Creek Cider® series) and custom-crafted private label products keep us at the forefront of the craft beer revolution and still proudly contesting the beer trends of today. Big Rock has brewing operations in Calgary, Alberta, Vancouver, British Columbia, and Toronto, Ontario. Big Rock trades on the TSX under the symbol “BR”. For more information on Big Rock visit www.bigrockbeer.com

For further information, please contact:

Don Sewell

Chief Financial Officer

Phone: (403) 720-3239

Fax: (403) 720-3641

Email: investors@bigrockbeer.com