let’s partner up

BIG ROCK BREWERY INC. ANNOUNCES Q1 2019 FINANCIAL RESULTS

For Immediate Release

Calgary, Alberta — Big Rock Brewery Inc. (TSX: BR) (“Big Rock” or the “Corporation“) today announced its financial results for the three month period ended March 31, 2019.

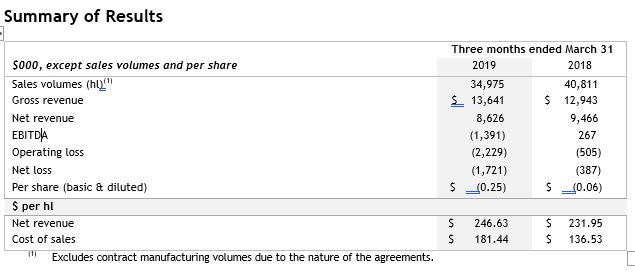

“Big Rock grew its gross revenue by $0.7 million (5%) to $13.6 million for the quarter ended March 31, 2019, however, given the 104% increase in the Alberta beer mark-up imposed on Big Rock by the former Government of Alberta, Big Rock saw a decline in net revenue of $0.8 million (9%) in Q1,” said President & CEO Wayne Arsenault, “Although the fundamentals of the business continue to improve, the impact of the Alberta beer mark-up amendment was a reduction to our net revenue of $1.8 million based on our Alberta beer sales volumes in the first quarter.”

In late 2018, the former Government of Alberta proposed financial support to Big Rock as a temporary measure until the former Government of Alberta’s trade-related issues were resolved and a new permanent beer mark-up policy in the province is established. As a result, Big Rock received a grant letter from the former Minister of Agriculture and Forestry of Alberta, however, Big Rock was recently advised that this financial support is being withdrawn. Given the interim financial support that Big Rock discussed and agreed to and the ongoing discussions for a more permanent solution, Big Rock did not drastically alter its business operations in this interim period while these discussions were ongoing. In response to the withdrawal of the previously agreed to amounts, Big Rock plans to implement larger cost-cutting and pricing initiatives as uncertainty around the current regulatory environment on beer persist longer than expected.

“Despite the regulatory headwinds Big Rock is currently experiencing as a result of the former Government of Alberta’s policy, our core business is performing well and we will adapt our business accordingly given the economic environment,” said Mr. Arsenault, “As an aside, the performance of our 2019 product launches and the soon-to-come introduction of Iconic Brewing Company’s line-up of brands in Alberta and British Columbia have us excited.”

Financial Highlights

For the quarter ended March 31, 2019, as compared to the same quarter in 2018, the Corporation:

- gross revenue increased by 5.4%, from $12.9 million to $13.6 million;

- net revenue decreased by 8.9%, from $9.5 million to $8.6 million;

- reported loss before interest, taxes, depreciation and amortization (“EBITA”) of $1.4 million as compared to earnings of $0.3 million;

- reported operating loss of $2.2 million, compared to an operating loss of $0.5 million;

- increase in net loss to $1.7 million from $0.4 million; and

- cash used in operating activities of $1.2 million as compared to $1.2 million

Operating Highlights

Big Rock reported a net loss of $1.7 million for the first quarter of 2019 compared to a net loss of $0.4 million in the first quarter of 2018, despite gross revenue growing by $0.7 million (5%) to $13.6 million in the first quarter of 2019. Big Rock’s operating loss of $2.2 million, for the quarter ended March 31, 2019 increased by $1.7 million (341%), compared to an operating loss of $0.5 million during the same period in 2018, due to the elimination of the Alberta Small Brewers Development (“ASBD”) program and the resulting increase in the net Alberta beer mark-up on Big Rock’s sales volumes to $1.25 per litre (from ~$0.61 per litre). The overall impact of this amendment was a reduction to Big Rock’s net revenue of $1.8 million based on the Corporation’s Alberta beer sales volumes in the first quarter.

In late 2018, the former Government of Alberta announced the elimination of grants within the ASBD program and a graduated mark-up system for Alberta producers of less than 50,000 hectolitres per year. The impact of the ASBD grant elimination resulted in a 104% increase in the net Alberta beer mark-up for Big Rock sales volumes in the province. In response to this, the Corporation pursued significant price increases across all product offerings and small cost-cutting initiatives across operations. Prior to the recent provincial general election in Alberta, the Corporation had received a signed grant letter from the former Minister of Agriculture and Forestry, subject to definitive documentation, that would allow the Corporation to continue to execute its 2019 plan and pursue its near and long-term growth plans. On May 13, 2019, the Corporation received notice from the new Ministry of Agriculture and Forestry of Alberta that it would not be receiving the financial support previously agreed to. The Corporation has been evaluating the implications of this notice since. The Corporation continues to work with the new Government of Alberta to implement a permanent Alberta beer mark-up policy change that provides for a stable and predictable economic environment for Alberta craft brewers and, in the near-term, the Corporation plans to implement significant cost reductions.

Additional Information

The unaudited consolidated financial statements and Management’s Discussion and Analysis for the three months ended March 31, 2019, dated May 14, 2019, can be viewed on Big Rock’s website at www.bigrockbeer.com and on SEDAR at www.sedar.com under Big Rock Brewery Inc.

Forward-Looking Information

Certain statements contained in this news release constitute forward-looking statements. These statements relate to future events or Big Rock’s future performance. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking information are not facts, but only predictions and generally can be identified by the use of statements that include words or phrases such as, “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “likely” “may”, “project”, “predict”, “propose”, “potential”, “might”, “plan”, “seek”, “should”, “targeting”, “will”, and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Big Rock believes that the expectations reflected in those forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon by investors as actual results may vary materially from such forward-looking statements. These statements speak only as of the date of this news release and are expressly qualified, in their entirety, by this cautionary statement.

In particular, this news release contains forward-looking statements pertaining to the following:

- the Corporation’s growth plans;

- the implementation of cost-cutting measures by the Corporation and the significance thereof;

- the launch of new products by the Corporation, including, but not limited to, Iconic Brewing Company’s line-up of brands;

- the Corporation’s ability to, and corresponding results of, work with the Alberta government;

- the continued impact of Alberta mark-up rates on the Corporation;

- the impact of future changes to the regulatory regime and mark-up rates on the Corporation; and

- the Corporation’s ability to execute on its growth plans.

With respect to forward-looking statements listed above and contained in this news release, Big Rock has made assumptions regarding, among other things, the following:

- volumes in the current fiscal year will remain constant or will increase;

- input costs for brewing and packaging materials will remain constant or will not significantly increase or decrease;

- there will be no material change to the regulatory environment, including the mark-up and grant rates, in which Big Rock operates;

- there will be no supply issues with Big Rock’s vendors; and

- the Corporation’s ongoing discussions with the Alberta Government with respect to the mark-up, grant program and treatment of craft brewers in the province.

Some of the risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking information and statements contained herein include, but are not limited to:

- the inability to continue to reduce the net mark-up rate in Alberta; and

- the inability to continue to grow demand for Big Rock’s products.

Readers are cautioned that the foregoing list of assumptions and risk factors is not exhaustive. The forward-looking information and statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking information and statements included in this news release are made as of the date hereof and Big Rock does not undertake any obligation to publicly update such forward-looking information and statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws.

Non-GAAP Measures

The term “earnings before interest, taxes, depreciation and amortization” (EBITDA) is not a recognized measure under GAAP and may not be comparable to that reported by other companies. EBITDA is calculated by adding back to net income, interest, income taxes and depreciation and amortization. Management uses this measure to evaluate the Corporation’s operating results. A reconciliation of EBITDA to net income (loss), the nearest GAAP measure, is contained under the section “Liquidity and Capital Resources – Capital Strategy” in the Corporation’s Management’s Discussion and Analysis for the three months ended March 31, 2019, dated May 14, 2019, which can be viewed on Big Rock’s website at www.bigrockbeer.com and on SEDAR at www.sedar.com under Big Rock Brewery Inc.

About Big Rock Brewery Inc.

In 1985, Ed McNally founded Big Rock to contest the time’s beer trends. Three bold, European-inspired offerings – Bitter, Porter and Traditional Ale – forged an industry at a time heavy on easy drinking lagers and light on flavour. Today, our extensive portfolio of signature beers, ongoing seasonal offerings, five ciders (Rock Creek Cider® series) and custom-crafted private label products keep us at the forefront of the craft beer revolution and still proudly contesting the beer trends of today. Big Rock has brewing operations in Calgary, Alberta, Vancouver, British Columbia, and Toronto, Ontario. Big Rock trades on the TSX under the symbol “BR”. For more information on Big Rock visit www.bigrockbeer.com

For further information, please contact:

Wayne Arsenault, President & Chief Executive Officer, or Don Sewell, Chief Financial Officer:

Phone: (403) 720-3239

Fax: (403) 720-3641

Email: investors@bigrockbeer.com